Grid Flexibility: Learning Heterogeneous Elasticity and Dynamic Pricing of Rewards for Demand Response

|

The increasing frequency of extreme weather events are presenting profound difficulties in safely operating electric power systems around the world. For instance, in 2022, the California Independent System Operator (ISO) noted that record-breaking temperatures during summer heat waves are leading to historic high demands for power, putting greater strain on the electrical grid and significantly increasing the likelihood of rotating outages unless consumers can reduce their energy use even more than they have so far. Various researches have also noted that the heightened uncertainty in electricity generation coming from renewable energy resources can destabilize the system unless more demand-side management are set into place.

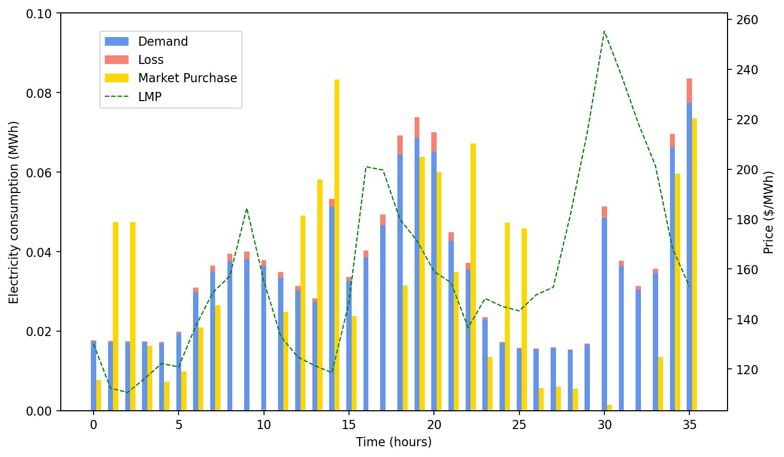

Demand response (DR), defined as “the changes of end-consumers’ electricity consumption in peak hours from their normal patterns,” has gained popularity as a means (and a resource) to solve the reliability and efficiency issues of the power grid. As more residential real estate (RRE) and commercial real estate (CRE) owners explore innovative ways to cut cost and conserve energy, DR offers a powerful alternative for achieving these goals, and at the same time, contributing to the overall grid stability. In addition to benefiting the overall stability of the power grid, DR can financially benefit load aggregators (LA), entities that purchase electricity at real-time wholesale prices and supply them at a flat rate to end-customers. During time periods when the wholesale price of electricity exceeds the flat rate that LAs receive from the customers, it is actually financially beneficial for them to encourage the customers to reduce consumption by offering monetized rewards.

Many ISOs and LAs in the U.S. in fact already have several DR programs in their operating areas. However, most of them are reporting lower than expected participation, due to reasons such as non-flexibility of demand and information asymmetries. According to the U.S. Department of Energy, residential electricity consumption constitutes over 38% of the total U.S. electricity consumption, forming a large pool of flexibility that we can exploit. One of the reasons why demand response has been largely unsuccessful in the residential sector is because there is a lack of understanding of consumer-specific behavior patterns. In this research, we establish a framework for understanding the heterogeneous elasticity of electricity consumption in the face of monetary rewards, and utilize that information for the dynamic pricing of such rewards. We aim to predict the elasticity of electricity demand specific to each consumer and appliance (e.g., HVAC, lighting, laundry, EV charging) given external factors such as day of week, time of day, temperature/humidity, lifestyle, building characteristics. Then, those elasticity information will be used to design a reward pricing mechanism that will dynamically change the amount of reward based on the current state of the system. The project will leverage optimization/machine-learning tools and financial models through the collaboration among experts in Management Science and Engineering.